With the backdrop of intense U.S. pressure over India’s Russian oil imports, Indian External Affairs Minister S. Jaishankar visited Moscow from August 19 to 21. The visit signaled New Delhi’s resolve to maintain and even strengthen the relationship with Russia. Even as top U.S. officials continue to spotlight India’s crude oil purchases, the expected growth of Indian imports in the month of September made global headlines. But Jaishankar’s visit highlighted New Delhi’s intention to broaden the relationship in earnest, pushing the India-Russia economic relationship beyond crude oil towards a more durable and diverse trade footprint that can withstand international pressure and sanctions. In service of this goal, recent India-Russia engagements have focused on improving trade mechanics, including payments, logistics, and market access, by easing rupee settlement bottlenecks, advancing free trade agreement (FTA) talks, and floating liquid natural gas (LNG) purchases. This new phase marks a break from the past, as long-discussed ideas begin to translate into measurable flows and institutional negotiations. India’s facing mounting U.S. economic pressure and older attempts at diversification—like trade agreements in Southeast Asia—not having been as fruitful as expected have driven New Delhi to move from rhetoric to action in its economic relationship with Russia.

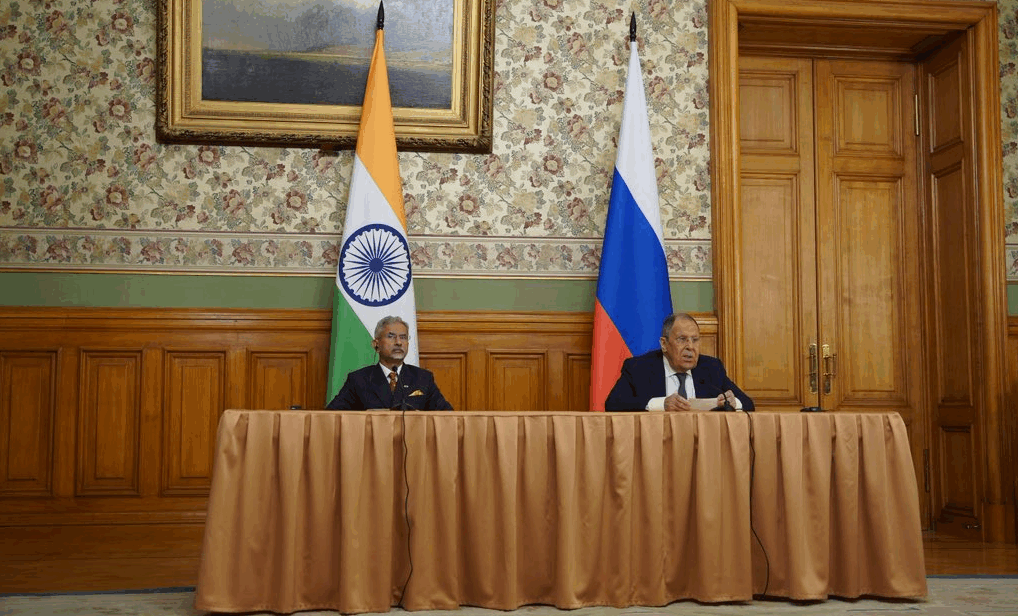

Jaishankar in Moscow

Throughout August, U.S. officials publicly scrutinized Indian purchases of Russian oil, framing such imports as the key enabler of Russia’s ongoing war in Ukraine. However, this pressure campaign has come at a time when international observers increasingly see Russia in a position of strength at the diplomatic table. The Trump-Putin summit in Alaska on August 15 was received positively by India and seen as preserving space for New Delhi’s strategic engagement with Moscow, as evidenced by the Modi-Putin phone call three days later. In this context, Jaishankar’s visit can be seen as an attempt to stabilize and strengthen India-Russia ties despite mounting U.S. pressure.

Jaishankar’s visit can be seen as an attempt to stabilize and strengthen India-Russia ties despite mounting U.S. pressure.

During the trip, Jaishankar co-chaired the India-Russia Inter-Governmental Commission on Trade, Economic, Scientific, Technological and Cultural Cooperation (IRIGC-TEC), which emphasized three focus areas: payment facilitation, connectivity and logistics, and market access. Terms of Reference for an India-Eurasian Economic Union (EAEU) FTA and a formal protocol were finalized, paving the way for official negotiations. In a press release, the Indian Ministry of External Affairs stressed addressing tariff and non-tariff barriers, removing logistics bottlenecks, enabling smooth payment mechanisms, and concluding both the Economic Cooperation Programme until 2030 and the India–EAEU FTA “at the earliest” to jump from the current bilateral trade volume of USD $68.7 billion to the revised target of USD $100 billion by 2030.Jaishankar’s public line in Moscow was pointed: India must start “doing more and doing differently” in relations with Russia.

Rupee Settlement Efforts

Jaishankar’s emphasis is underlined by concrete Indian policy actions recently to ease the payment mechanisms issue, which has been a key obstacle in the relationship over the past three years. Before his visit, the Reserve Bank of India (RBI) removed the prior-approval hurdle for opening Special Rupee Vostro Accounts (SRVAs) used to conduct international trade in rupees. Crucially, the RBI also changed policy to allow SRVA rupee surpluses to be invested fully in Indian government securities, creating a yield-bearing parking lot for stranded rupees. These shifts are critical for Russian oil sellers who sat on large rupee balances after 2022—peaking around $8 billion at one stage—and complained about limited deployment and convertibility. With these two recent changes to SRVA regulations, Russian sellers to India will benefit from greater convenience and improved returns on rupee holdings, turning virtually dead cash into yield in India’s safest asset.

However, rupee settlement would still mean convertibility headaches for Russian firms, since rupee balances cannot be freely moved offshore or exchanged into hard currency. For Indian banks and companies, the issue is the risk of secondary sanctions, since facilitating such payments exposes them to U.S. and EU scrutiny. Together, these frictions limit the attractiveness of the rupee trade mechanism despite recent regulatory tweaks.

To address the convertibility barrier, India and Russia are reportedly looking to establish a dynamic reference exchange rate—currently, the process requires first converting INR to USD then USD to RUB, which is cumbersome and complex due to international financial restrictions on Russia. Notably, the UAE-India local currency settlement model provides a helpful precedent, normalizing bilateral settlement via parallel trade rails—not the wholesale replacement of the dollar. Crucially, however, such systems depend on sufficient trade volumes on both sides to keep accounts balanced and usable. This is where India and Russia’s effort to expand their trading relationship becomes central—building diverse economic ties that can withstand international pressure while also generating the flows necessary for payment settlement mechanisms.

Expanding Trade

Efforts to expand the economic relationship have included the development of trade corridors and—increasingly—a focus on market access. The revival of long-stalled projects marks an important step in India-Russia economic engagement, signaling both sides’ commitment to finally operationalizing initiatives that had remained on paper for years. On the logistics front, the Vladivostok-Chennai (Eastern Maritime Corridor)—first announced in 2019—was made operational last year, cutting 15 to 16 days off the traditional route through Europe. With coal shipments rising by 87 percent and crude oil transport growing by 48 percent year-on-year in FY 2024-25, the corridor has become busier than ever. In parallel, the International North-South Transport Corridor (INSTC) through Chabahar port in Iran, long stuck in planning and political hurdles, is also ramping up trade volumes. The annual Indian economic survey underlined a 43 percent rise in vessel calls and a 34 percent bump in containers through INSTC in FY 2023-24.

Efforts to expand the economic relationship have included the development of trade corridors and—increasingly—a focus on market access.

Beyond logistics, India seeks greater market access in Russia to facilitate trade. With formal negotiations for an India-EAEU FTA underway, New Delhi sees this less as a lifeline for textiles hit hard by tariffs than as part of a broader diversification strategy. Global demand for textiles and garments tends to be relatively price-sensitive, and Indian textile exports are unlikely to be competitive in EAEU markets. Thus, rather than a like-for-like substitution, deals like an FTA with the EAEU are viewed as a means to offset trade disruptions by opening space for other, more competitive Indian sectors such as pharmaceuticals, machinery, and processed foods. But resolving non-tariff barriers will prove equally important to open Russian markets to Indian exports. Pharmaceuticals still needs EAEU-wide registrations; food and agricultural products often struggle to meet market standards; rail components and machinery run into testing/certification lags. Unless Moscow streamlines conformity assessments and mutual recognition, an FTA risks being tariff cuts on paper while non-tariff barriers stay in place. That is why MEA’s focus on non-tariff barriers matters.

Diversifying Energy Cooperation?

Moscow, for its part, dangled liquid natural gas (LNG) options during Jaishankar’s visit, with First Deputy Prime Minister Denis Manturov underscoring the potential for supplying more Russian LNG to India. However, there has been little reaction to this offer in New Delhi. On paper, a Far East or Arctic LNG stream into India would diversify supply, potentially via the Northern Sea Route in the summer. In practice, sanctions complicate Novatek’s Arctic LNG-2, and India’s stance has been to avoid sanctioned LNG. Unlike crude oil—where Indian refiners have built workarounds using non-Western tankers, insurance from Russian providers, and opaque trading channels—LNG requires long-term contracts, credit lines, and shipping tied to Western majors, making sanctions far harder to bypass. As a result, while India continues to absorb Russian crude despite Western pressure, it has been cautious not to entangle itself in sanctioned Russian LNG projects. Perhaps most importantly, any Russian attempts to supply LNG to India would compete with Qatar’s newly re-priced, cheap long-term volumes to India through 2048.

The timing of Manturov’s remarks is notable and indicates Moscow’s intentions to pitch Russia as an important partner in India’s economic diversification efforts. Outside the immediate context of U.S. tariffs, President Donald Trump had conveyed to Prime Minister Narendra Modi during their meeting in February that he wanted the United States to become India’s “leading supplier” of LNG. In this light, Russia’s LNG pitch functions as both a trade offer and a broader signal to Washington. Such signals have been paired with more explicit market access messaging. For instance, Russia’s chargé d’affaires in New Delhi, Roman Babushkin, said, “If Indian goods are facing difficulties entering the US market, the Russian market is welcoming Indian exports.”

Thus, Jaishankar’s Moscow trip was not just about symbolism but the practical business of addressing key challenges—payments, logistics, and market access—that have limited India–Russia trade in the past. The visit produced useful adjustments, but results will be visible only in the medium term. If rupee settlements expand, corridor schedules firm up, and specific non-tariff barriers ease, the strategy could prove useful. If not, India’s Russia channel risks remaining a fragile economic artery vulnerable to sanctions. With President Putin expected to visit India later this year, these issues are likely to dominate New Delhi’s agenda. Until then, Jaishankar’s Moscow visit has set the tone for the India-Russia relationship.

The article appeared in southasianvoices